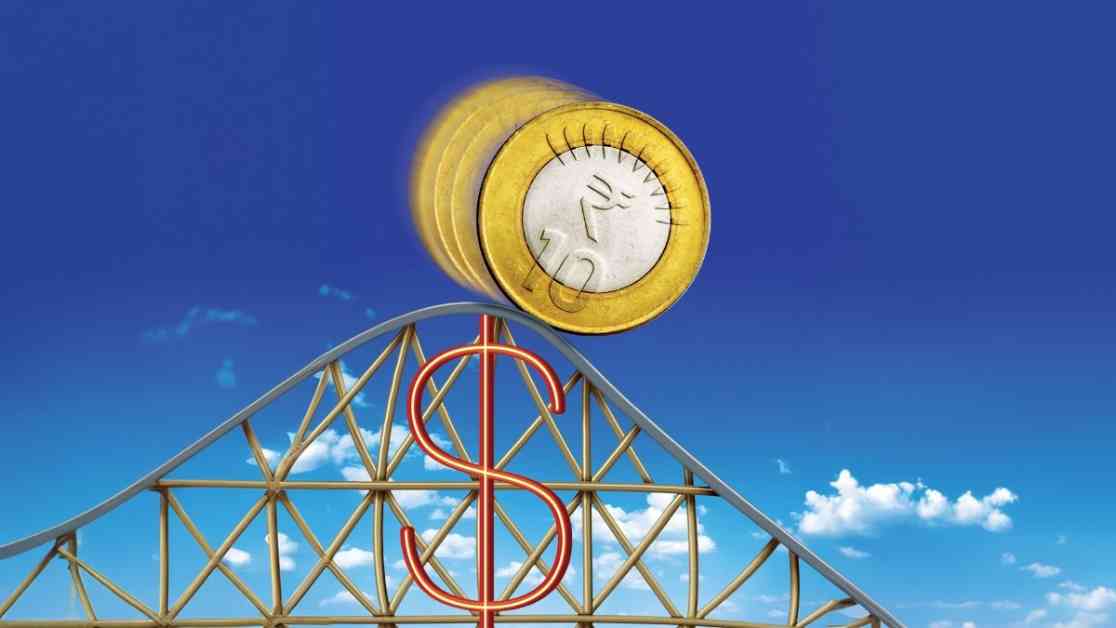

The global economic landscape has been tumultuous in recent times, with the rupee taking a hit alongside other currencies due to the strengthening of the dollar following Donald Trump’s presidency. As Sanjay Malhotra assumes his role as the new Governor of the Reserve Bank of India, he steps into a challenging environment marked by a slowing Indian economy, rising oil prices, and a depreciating rupee. The question on everyone’s mind is whether this trend of rupee depreciation will persist and what implications it holds for India’s economic future.

Impact of Rupee Depreciation on India’s Economy

The depreciating value of the rupee has significant implications for India’s economy, affecting various sectors and industries. One of the immediate consequences of rupee depreciation is the increase in the cost of imports, particularly oil. India is heavily reliant on oil imports to meet its energy needs, and a weaker rupee makes these imports more expensive, putting pressure on the country’s current account deficit.

Moreover, a depreciating rupee can lead to inflationary pressures, as the cost of imported goods and commodities rises. This, in turn, can impact consumer spending and overall economic growth. Industries that rely heavily on imports, such as electronics and automobiles, may also feel the pinch of a weaker rupee, as their input costs rise.

To mitigate the impact of rupee depreciation, the Reserve Bank of India may intervene in the foreign exchange market to stabilize the currency. However, such interventions can only provide temporary relief, and long-term solutions to address the root causes of rupee depreciation are essential for sustainable economic growth.

Expert Insights and Projections

Experts in the field of economics and finance have weighed in on the issue of rupee depreciation, offering insights into the factors driving this trend and its potential implications for India’s economy. According to Dr. Neha Sharma, a renowned economist, the recent depreciation of the rupee can be attributed to a combination of global factors, including geopolitical tensions, trade wars, and fluctuations in oil prices.

Dr. Sharma warns that if the rupee continues to depreciate, it could lead to a vicious cycle of inflation and economic instability. She emphasizes the need for prudent fiscal and monetary policies to address the root causes of rupee depreciation and restore confidence in the currency.

Looking ahead, economists predict that the rupee may face further depreciation in the coming months, as global economic uncertainties persist. Factors such as the outcome of trade negotiations, geopolitical developments, and monetary policy decisions will play a crucial role in determining the future trajectory of the rupee.

In conclusion, the depreciating rupee poses significant challenges for India’s economy, requiring a multi-faceted approach to address its root causes and mitigate its impact on various sectors. As Sanjay Malhotra steps into his role as the new Governor of the Reserve Bank of India, all eyes are on him to steer the country through these turbulent economic waters and pave the way for sustainable growth and stability.