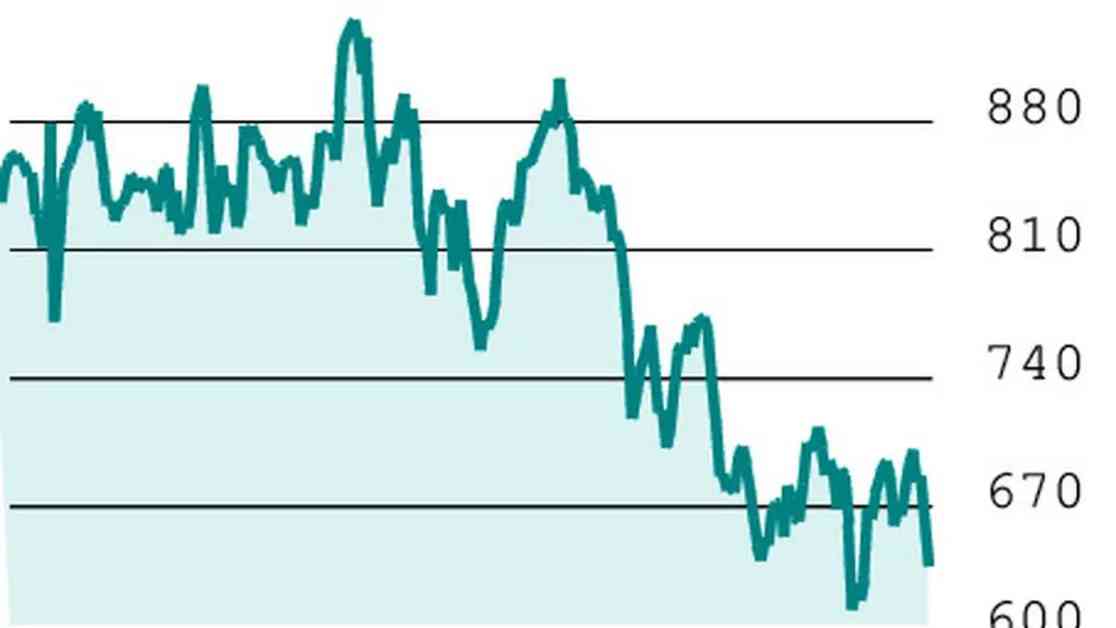

The DLF stock, currently priced at ₹631.70, is facing some tough times ahead. It has immediate support levels at ₹612 and ₹557. If it falls below ₹557, things could turn pretty negative, leading to a sharp decline in the stock price. On the flip side, resistance levels are at ₹686 and ₹760. A breakthrough above ₹686 could signal a positive shift in DLF’s outlook. Overall, the stock is expected to trade in a narrow range with a downward bias.

In terms of F&O indicators, the DLF May futures closed at ₹633.20 on Friday, slightly higher than the spot price. However, there has been a decrease in open interest over the past ten days, indicating traders’ nervousness due to the stock’s volatility. Option trading suggests that DLF might fluctuate within the ₹600-700 range.

For a trading strategy, investors could consider buying a 630-put option, which closed at a premium of ₹24.40. With a market lot size of 825 shares, the total cost would be around ₹20,130 per lot. This investment could result in a maximum loss if DLF’s stock price sees a significant rise. Aiming for a target of ₹32 with an initial stop-loss at ₹18 is recommended. If the premium surpasses ₹26, the stop-loss can be adjusted to ₹24 to protect potential profits. Given DLF’s high volatility, traders must be cautious with their stop-loss placements to avoid sudden reversals in the stock’s direction.

On Monday, it might be wise to reevaluate the trade if DLF opens significantly higher or lower than expected. Following the recommendations on Angel One could potentially yield profits, but it’s essential to remember that trading always carries a risk of loss.

In conclusion, the DLF stock is at a critical juncture, with key support and resistance levels determining its future trajectory. Traders need to be vigilant and adapt their strategies accordingly to navigate the market’s uncertainties. Embracing imperfection and being flexible in decision-making are crucial in the ever-changing landscape of stock trading.