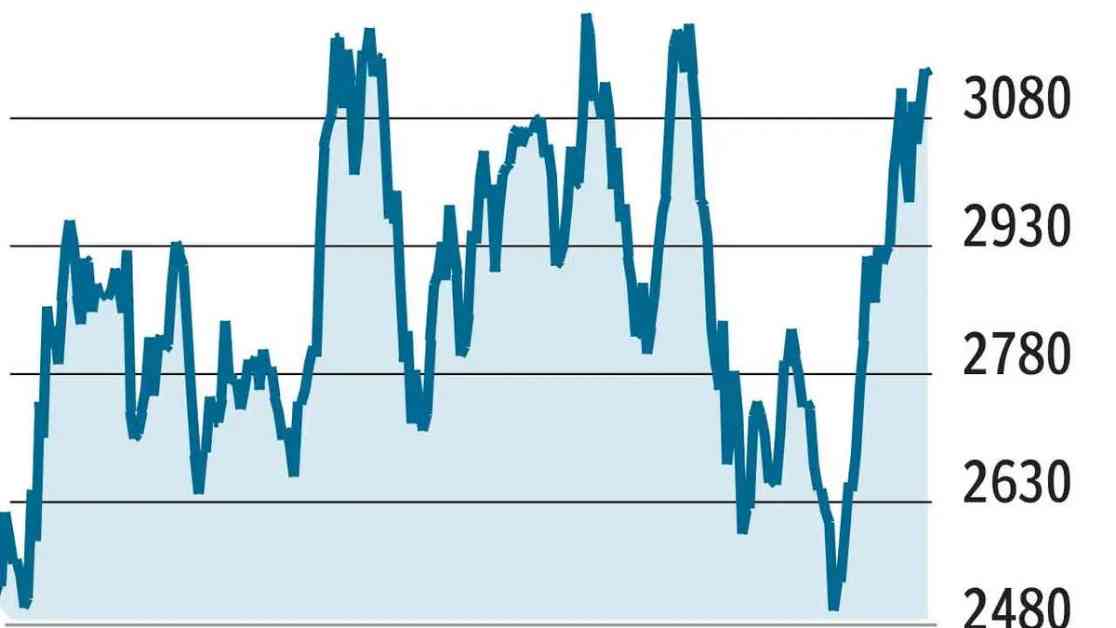

The stock of Mahindra & Mahindra (M&M) is currently at a crucial level, trading at ₹3,135.60. The stock is facing immediate support at ₹3,053 and ₹2,886. If it drops below the latter, the short-term outlook for M&M could turn negative. However, if M&M manages to stay above ₹3,088, it has the potential to reach new highs. Overall, it is expected that the stock will trade in a narrow range with a negative bias.

F&O Pointers: The March futures for M&M closed at ₹3,147.80, higher than the spot close of ₹3,135.60. This indicates the presence of long positions in the market. Despite a steady increase in underlying value, the May futures for M&M saw unwinding of positions. Option trading signals suggest that the stock may fluctuate within the ₹2,800-3,400 range.

Strategy: Traders can consider buying the 3150-put option, which closed with a premium of ₹64.25. With a market lot of 175 shares, this strategy would cost traders ₹11,243.75, representing the maximum potential loss. For this strategy to result in a loss, M&M would need to hold above ₹3,150. The break-even point for this trade is ₹3,085.75. Traders can aim for a target of ₹100, with an initial stop-loss set at ₹45. If the premium rises to ₹70, the stop-loss can be shifted to ₹60 to protect profits. As the expiry date is approaching, traders are advised to adjust their stop-loss levels accordingly. If M&M opens strongly on Monday, it may be wise to stay on the sidelines.

Follow-up: DLF started the week on a strong note, which may not have provided traders with an entry point.

The recommendations in this article are based on technical analysis and F&O positions. Trading always carries a risk of loss, so it is important for traders to be cautious and manage their positions accordingly.